The companies have to pay the corporate income tax on profit distribution only, whereas the individual shareholders do not pay 10% dividend tax anymore.

Introduction

As of 1 January 2018, the companies are applying a conceptually new corporate income tax in Latvia. In this article, I have outlined the main features of the new tax, its impact on different shareholders and the ways to how to benefit from it. To make it easier to read, I have summarized most important things first and then describe the tax in more detail.

Summary

General

The new corporate income tax is payable upon the distribution of profits only. Until the Latvian company keeps the profits, 0% tax is payable. The tax is payable following 20%/80% rule, where the net amount is multiplied by 20%/80% to calculate the tax.

The main benefit of the new tax is that the payment of it could be postponed, thus allowing to reinvest it into operations, investment vehicles or simply keep the cash. By paying the tax later the company benefits from the time value of the postponed tax payment.

Shareholders

For local individual shareholders, the new tax is more beneficial since they do not pay dividend tax anymore. The new tax rate is 20% of the gross dividends instead of previous 15 % Latvian corporate income tax and 10% personal income tax. Latvian tax residents pay no tax on of the dividends they receive from the foreign countries. Thus Latvia is becoming a good place to save taxes on profits repatriated from overseas investments.

For foreign individual shareholders who are holding shares in a Latvian company, it is advisable to reconsider their investments. If they plan to distribute profits, the tax payable in Latvia will most likely not be credited against the dividend tax payable in their residence countries. As a potential solution a foreign individual may:

(i) either change its tax residence to Latvia to get rid of the dividend tax,

(ii) place a holding company between the Latvian operating company and him/her or

(iii) partly replace the equity financing by loan financing.

For the foreign legal entities, the increase of the tax rate from 15% to 20% will be outweighed by the time value of the postponed tax. Therefore, in the long run, the impact will be neutral. The only exception probably is manufacturing companies which lose current tax reliefs related to the acquisition of the new equipment etc.

Financing

The Latvian law does not restrict the financing the company through a loan (except, thin capitalization rule described below), however, it restricts the withdrawal of the cash from the Latvian company via a loan.

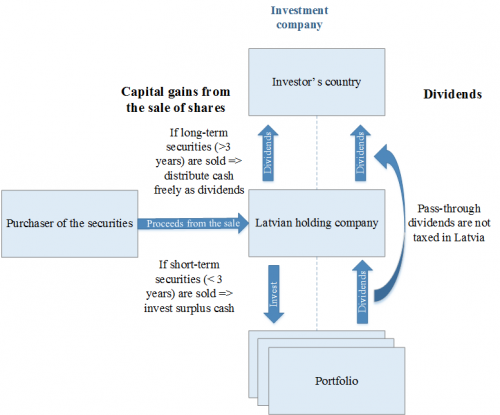

Holding company

A Latvian company has advantages of a holding company since:

(i) the sale of shares is tax-exempt provided that the Latvian company has held them for 3 years and

(ii) the flow-through dividends are tax exempt.

Principle of the new Latvian corporate income tax

The new Latvian corporate income tax follows the cash flow principle. The Latvian company pays tax only when it distributes dividends, deemed dividends or notional profit. This means that the Latvian company should not pay tax on the annual profits until one of the above distributions occur.

Let’s start with an example. Assume that a Latvian company has generated 1,000,000 euros profit in 2018. If the Latvian company does not distribute profit, no tax liability arises. However, if the shareholders decide to distribute it wholly, then it has to pay tax amounting to 20%/80% principle. This means that the net dividend amount should be divided by 80% and multiplied by 20%. If the shareholder wants do distribute 100% as a net dividend, then the tax payable will be 250,000 = 1,000,000 : 80% x 20%.

The overall advantage of the tax is that its payment is being suspended for the distribution of the profits, so it could be reinvested or simply kept as a cash. Therefore, the tax is beneficial primarily for the companies that do not plan to distribute profits or at least plans to postpone them.

The tax is beneficial also for the foreign entities which are established with the purpose to carry out one or another function for the group. The typical examples of such entities are a contract manufacturer, a limited risk distributor, a holding company or a shared service centre. Usually, these entities are so-called “cost centres” and they accumulate profit only to satisfy the transfer pricing requirements.

Tax rate

The tax is not payable for undistributed profits, until the profit is kept at the company the tax is zero-rated.

The tax rate is considered as 20% of the gross dividend amount. Continuing the previous example, the 20% rate applies to the gross dividend amount. To calculate the gross amount the net dividends (so the number of dividends the shareholder wishes to receive) should be divided by 0,8 to calculate the gross amount and then the 20% should be applied. The effective tax rate, i.e. the payable to net dividend amount is 25%.

The comparison of the corporate income tax systems in the past and in future is provided here.

Impact on shareholders

The new Latvian corporate income comes not without changes also for the shareholders. However, the impact will vary depending on the shareholders status as follows.

Shareholders: Latvian resident individuals

The dividends received in the hands of individuals who are residents in Latvia are tax-free. This follows from the principle that the new corporate income tax includes both corporation and personal tax for the income received.

The free flow of capital principle requires that the shareholders should be equally treated. Therefore, the dividends Latvian tax residents receive from the foreign companies are exempt from the taxes, provided that the dividend payer has paid the corporate income tax out of this profit generated. This is a considerable incentive for foreign investors who consider changing its tax residence to Latvia in order to save on taxes on their investments.

Shareholders: foreign resident individuals

This is more complex, since the Latvian corporate income tax is not an income tax at source and therefore the residence country will not allow it as a tax credit. For example, if a Russian resident a sole shareholder in a Latvian company which is going to distribute the dividends amounting to 100,000 euros, the Latvian corporate income tax payable will be 25,000 euros. Russian resident will receive 100,000 euros and will have to pay in Russian another 9% of the dividends received. Thus the effective tax rate will increase to be 34% which is quite considerable.

How to minimize the tax burden? Apparently, a foreign individual will have to put some layer between a Latvian company and him/her as foreign tax resident. A simple holding company will do. The alternative is to partly finance the Latvian company through a loan. This is especially because the new law restricts the interest payments only by the level of equity and transfer pricing requirements.

Shareholders: Foreign legal entities

The existing tax burden of a Latvian company is increased from 15% to 20%. However, if the dividends are postponed, the time value of the tax paid later will outweigh the increase of its nominal value. So basically to save the tax, it is advisable to postpone the tax payment as long as possible to benefit from the fact that the future value of the postponed tax is lower than its present value.

Tax base

As mentioned above the new Latvian corporate income tax is payable upon the distribution of profits via dividends, but not only dividends. The tax base includes other items in addition to simple profit distribution.

So the corporate income tax is payable upon both: profit distribution and notional profit distribution.

Profit distribution

Profit distribution includes:

- regular and extraordinary dividends;

- expenses equalized to dividends;

- notional (or “deemed”) dividends (Article 7).

Notional profit distribution

The following payments are considered as notional profit distribution subject to corporate income tax:

- expenses not related to economic activity (Article 8);

- bad debts (Article 9);

- excess interest payments (thin capitalization rules), calculated according to Article 10 of the Act;

- loans to the related persons (Article 11);

- transfer pricing adjustments:

- the excess over the arm’s length value, if the company has purchased goods/services from a related party above the arm’s length, and

- lack of the value received if the company has sold the goods/ services to a related party below the arm’s length value.

- goods that the non-resident allocates to their employees or members of the board (council);

- liquidation quota.

The taxable base does not include (i.e. is not taxed) representative expenses and expenses for events for sustainability of personnel, not exceeding 5% of pre-taxation year’s gross wages.

Holding company benefits

The new Latvian corporate income tax regime has two kinds of benefit that are relevant for a holding company: participation exemption and non-taxation of the flow-through dividends.

Participation exemption

A Latvian company can reduce the tax base by the capital gains the company has earned from the sale of shares, if the Latvian company has held the shares for at least 36 months at the moment of the sale (Article 13). Of course, if a Latvian holding company sells the shares which it has owned for less than 3 years, the company should not pay tax. However, if the company has held the shares for 3 years, the company can distribute the capital gains as dividends tax-free. So this means that the new Latvian corporate income tax facilitates long-term investment, however, also the short-term security speculation is beneficial, provided that the company reinvests the gains and do not distribute them.

Flow-through dividends

The pass-through dividends is an inseparable element of the new Latvian corporate income tax. Since the profits should be taxed only once, the flow-through dividends are not taxed the second time. So, if the Latvian company receives dividends from another Latvian entity or a foreign entity which has paid the corporate income tax in its country, the company will distribute these flow-through dividends tax-free. This principle does not apply to the dividends received from low-tax (offshore) jurisdictions.

This is a good tool for investing in the companies that have stable and high dividend payout ratio since the dividends could be passed through the holding company without paying any tax.

The following picture illustrates the structure how the new corporate income tax could be used for investment purposes.

As written above the pass-through (flow-through) dividends are not taxed in the hands of the Latvian investment company and they could be easily distributed. The long-term investment sales will result in no tax, as well. The income from the short-term sales could be used for reinvestment.

Financing

Loans issued to the related parties

The new Latvian corporate income tax law restricts the issue of loans to the shareholders and related parties other than subsidiaries. However, there is a number of exceptions from the loans to the related parties.

Loans granted to the related parties is the notional profit distribution subject to 20%/80% rule, except for the following loans issued by:

- a shareholder to its subsidiary;

- a company to its foreign permanent establishment,

- agricultural and forestry cooperatives to its members, if the loan is granted to facilitate the business of the member.

The rule does not apply to the loan:

- that a company has received from an unrelated company;

- issued during the tax year, if there is no opening retained earnings in the respective year;

- to the extent that does not exceed opening share capital value less the loans issued in the previous years, excluding the loans listed in the previous points;

- that are repayable within 12 months;

- issued by the company that has a status of the social company.

If the company has repaid the loan, it may reduce the tax payable by the amount of corporate income tax previously paid for this loan.

As a result, the law does not restrict the financing the company through a loan (except, thin capitalization rule described below), instead the law restricts withdrawal of the cash from the Latvian company via a loan.

Interest expense restrictions

The new Latvian corporate income tax maintains the thin capitalization rules, however, these new rules are more favourable and allow to increase the debt financing.

According to the new rules, the excess interest over allowable is the notional profit distribution subject to tax. The excess interest is:

- the excess interest calculated for the debt financing exceeding debt-to-equity ratio of 4-to-1;

- if the interest payments exceed 3 million euros, the excess interest is the amount over 30% of the EBITDA ratio.

The thin capitalization rules do not apply to the loans received from the credit institutions (in Latvia, EEA or double tax treaty country) and other financing received from specialized finance institutions.

The new thin capitalization rules does not consider the average bank credit interest rates anymore. In practice this means that for the loan financing the shareholder should structure the adequate share capital and should comply with the arm’s length value of the loan interest. Therefore, the interest rate should reflect the borrower’s risks and other factors. As a result, the allowable interest rate may be higher than previously.

Transfer pricing adjustments

The deviation from the arm’s length value which is favourable for the counter-party is the notional profit distribution subject to the corporate income tax. Therefore, a Latvian company in dealings with related parties should observe transfer pricing principles and prepare the transfer pricing documentation.

The current transfer pricing requirements are explained on my website dedicated to transfer pricing: www.transfer-pricing.lv.

Expenses not related to the economic activity

The new Latvian corporate income tax act equalizes the expenses not related to the business activity to the notional profit distribution subject to tax. Such expenses include:

- a company’s expenses for the private benefit to shareholders and employees (if not subject to personal taxation);

- a reduction in the profit, turnover or other basis made by a company or its shareholder;

- a company’s expenses for gifts, donations and loans (except income-equivalent loans subject to personal income tax);

- donations, with exception of the tax relief;

- cost of acquiring the assets acquired from 1 January 2018 and used for non-operating purposes and maintenance costs;

- depreciation and maintenance costs of the assets acquired before 31 December 2017 and used for non-business purposes;

- representation and staff sustainability expenses exceeding 5% of the previous year’s gross salary;

- expenses related to a representative car;

- assets, property or other benefits the taxpayer has used to commit a criminal offence and other unlawful acts;

- fines, penalties and penalties for non-compliance, if not adequate to the transaction value or made to low tax jurisdictions;

- surplus amounts of extraction (utilization) of natural resources;

- income not received from the transferred rights, with the exception of the cases;

- expenses for the maintenance of property pledged and real estate tax paid by a credit institution;

- fuel consumption in excess of the limits.

Permanent establishments

Permanent establishments pay the corporate income tax when its profit is transferred to the foreign head office. This means that the assets and liabilities of the permanent establishment should be accounted separately from the foreign entity’s assets/liabilities.

Taxation period

In general, the taxation period is a calendar month. The taxpayer should submit the return and pay tax on a monthly basis until the 20th date of the following month.

If a taxpayer has a reporting obligation on a quarterly basis, it will submit quarterly tax returns.

Tax reliefs

Not many tax reliefs have survived the tax reform. Below I summarize the applicable reliefs.

Tax relief for donations

Tax relief for donations (Article 12) to a designated public service organization, budget institution or a state corporation. The Latvian company may choose one of the following:

- exclude the donated amount from the tax base up to 5% of the previous year profit after calculated tax;

- exclude the donated amount from the tax base up to 2% of the total employees’ gross salaries;

- decrease the calculated corporate income tax of the dividends calculated in the taxation period of the previous financial year by 75% of the donated sum up to 20% of the calculated corporate income tax sum for the calculated dividends.

Limitation mentioned above applies to the total amount of donations within the financial year.

Large investment relief and special economic zones

The Latvian companies, whose aided investments project the Cabinet of Ministers has accepted by 31 December 2017, (Article 17.2), have the right to continue to use the large investment tax relief.

The corporation has a right to reduce the tax liability by the amount of the tax relief applicable in Special Economic Zones.

Submission of tax return

The company submits a single declaration to the State Revenue Service for the period from January to June of 2018. After submitting the first return it pays the corporate income tax by 20 July 2018. For the rest months, the company has to submit returns and pay tax by the 20th date of the following month.

If the taxpayer does not have taxable items in the month, it should not submit the return (excluding the return for the last month of the financial year).

Taxation of non-residents: withholding taxes

A Latvian company has to withheld the corporate income tax from the following payments to the non-residents:

- 20% of the management and consultancy fees

- 3% from the proceeds of disposal of the real estate (real estate company owning real estate for more than 50% of the assets);

- 20% of the payments to the low tax (offshore) jurisdictions. There might be exceptions in case if the purchases of goods are in line with the arm’s length value or the tax authority has granted a permit not to apply the tax.

Transitional issues

Tax losses carry forward

The tax losses accrued by 31 December 2017 are partially carry forward to the following years. The taxpayer can reduce the tax calculated on dividends by 15% of the accrued losses. If a company does not use the full amount of tax losses in 2018, it has a right to carry forward them next 4 financial years. However, the taxpayer cannot reduce the tax more than 50% of the tax liability of the particular year. Therefore, the companies that have accrued considerable tax losses probably will waste some amount.

Distribution of profit accumulated before 2018

The profits a Latvian company has generated until 31 December 2017 is being taxed with the “old” tax. There is a two-year transitional period during which the new corporate income tax in respect to the “old” profits is not applicable. For dividends payable to individuals (residents and non-residents) during this transactional period is subject to 10% personal income tax. Starting from 2021 the rate is 20%. For micro-tax payers in 2018 these dividends will be subject to 20% personal income tax for profits accumulated before and after 1 January 2018.

Tax advance payments

A taxpayer will pay tax in advance only during the transitional period from 1 January until 30 June 2018. The advance payments correspond to 1/12 of the tax assessed in 2016.

Tax-efficient exit from the business in Russia

Due to events known to all, at least some Latvian companies have been forced to suspend business with [...]

Expatriate employment options in Latvia

The article outlines the tax implications arising from the international assignment of an employee from the European Union [...]

Once again, who should prepare transfer pricing documentation and what documentation should be prepared

When receiving questions from clients, it is evident that there is still confusion as to who should prepare [...]

TEST: Taxation of a foreign employee. in Latvia

If you are sent to work in Latvia for a short or long period you have to be [...]